Research: It is really referred to as "self-directed" for the rationale. With the SDIRA, you are solely liable for comprehensively looking into and vetting investments.

Being an Trader, nevertheless, your options aren't restricted to shares and bonds if you decide on to self-direct your retirement accounts. That’s why an SDIRA can rework your portfolio.

A self-directed IRA is undoubtedly an exceptionally effective investment vehicle, but it surely’s not for everyone. As being the stating goes: with terrific electricity will come excellent accountability; and with the SDIRA, that couldn’t be additional accurate. Keep reading to master why an SDIRA may well, or may not, be in your case.

Better Costs: SDIRAs usually come with bigger administrative expenditures compared to other IRAs, as sure facets of the administrative system cannot be automatic.

Array of Investment Choices: Make sure the provider lets the types of alternative investments you’re serious about, like real estate property, precious metals, or non-public equity.

Criminals sometimes prey on SDIRA holders; encouraging them to open up accounts for the goal of making fraudulent investments. They frequently fool investors by telling them that When the investment is recognized by a self-directed IRA custodian, it has to be reputable, which isn’t genuine. All over again, make sure to do complete homework on all investments you end up picking.

Several buyers are surprised to understand that employing retirement cash to speculate in alternative assets has been possible given that 1974. Even so, most brokerage firms and financial institutions center on presenting publicly traded securities, like stocks and bonds, mainly because they absence the infrastructure and skills to handle privately held assets, like real estate or non-public equity.

Believe your Mate might be starting off another Fb or Uber? With the SDIRA, it is possible to spend money on causes that you believe in; and perhaps delight in higher returns.

Consumer Support: Look for a service provider that gives committed guidance, together with use of proficient specialists who can answer questions on compliance and IRS principles.

Constrained Liquidity: Lots of the alternative assets which might be held within an SDIRA, like real-estate, personal fairness, or precious metals, is probably not easily liquidated. This can be an issue if you must entry cash promptly.

And because some SDIRAs like self-directed traditional IRAs are subject to expected minimum distributions (RMDs), you’ll ought to plan ahead to ensure that you might have sufficient liquidity to meet The principles set via the IRS.

Complexity and Obligation: With the SDIRA, you have additional control more than your investments, but In addition, you bear far more accountability.

Entrust can assist you in paying for alternative investments using your retirement funds, and administer the obtaining and promoting of assets that are generally unavailable via financial institutions and brokerage firms.

Opening an SDIRA can give you use of investments normally unavailable through a lender or brokerage firm. Here’s how to begin:

Whether you’re a monetary advisor, investment issuer, or other money Expert, examine how SDIRAs could become a powerful asset to increase your business and accomplish your Experienced goals.

In some cases, the expenses linked to SDIRAs might be larger and much more complicated than with a daily IRA. It is because of the greater complexity linked to administering the account.

An SDIRA custodian is different mainly because they have the suitable workers, knowledge, and ability to take check here care of custody of the alternative investments. The first step in opening a self-directed IRA is to find a supplier that is certainly specialised in administering accounts for alternative investments.

Shifting funds from one variety of account to a different sort of account, including shifting resources from a 401(k) to a traditional IRA.

The tax advantages are what make SDIRAs interesting For numerous. An SDIRA could be each common or Roth - the account form you select will count largely on the investment and tax approach. Check with the economic advisor or tax advisor if you’re Uncertain which is ideal for you.

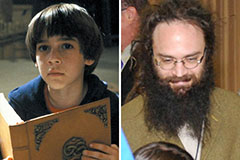

Barret Oliver Then & Now!

Barret Oliver Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now!